After tax profit margin formula

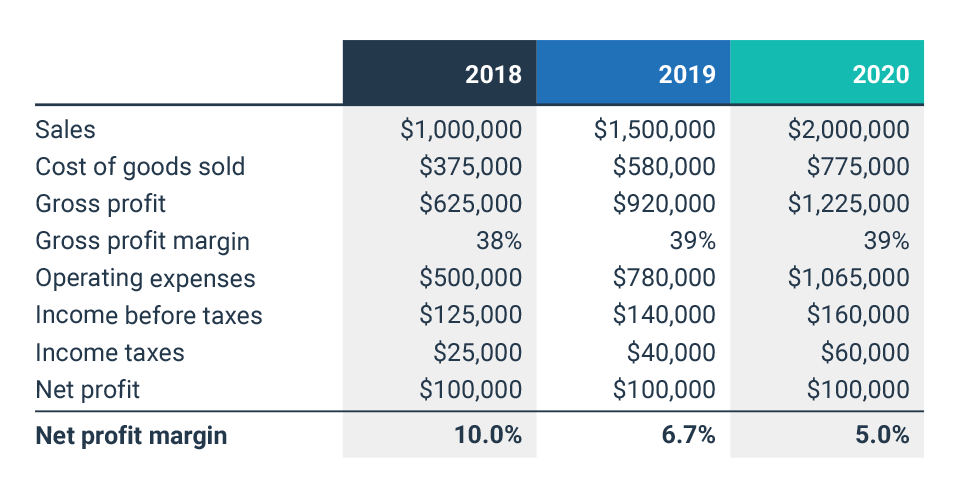

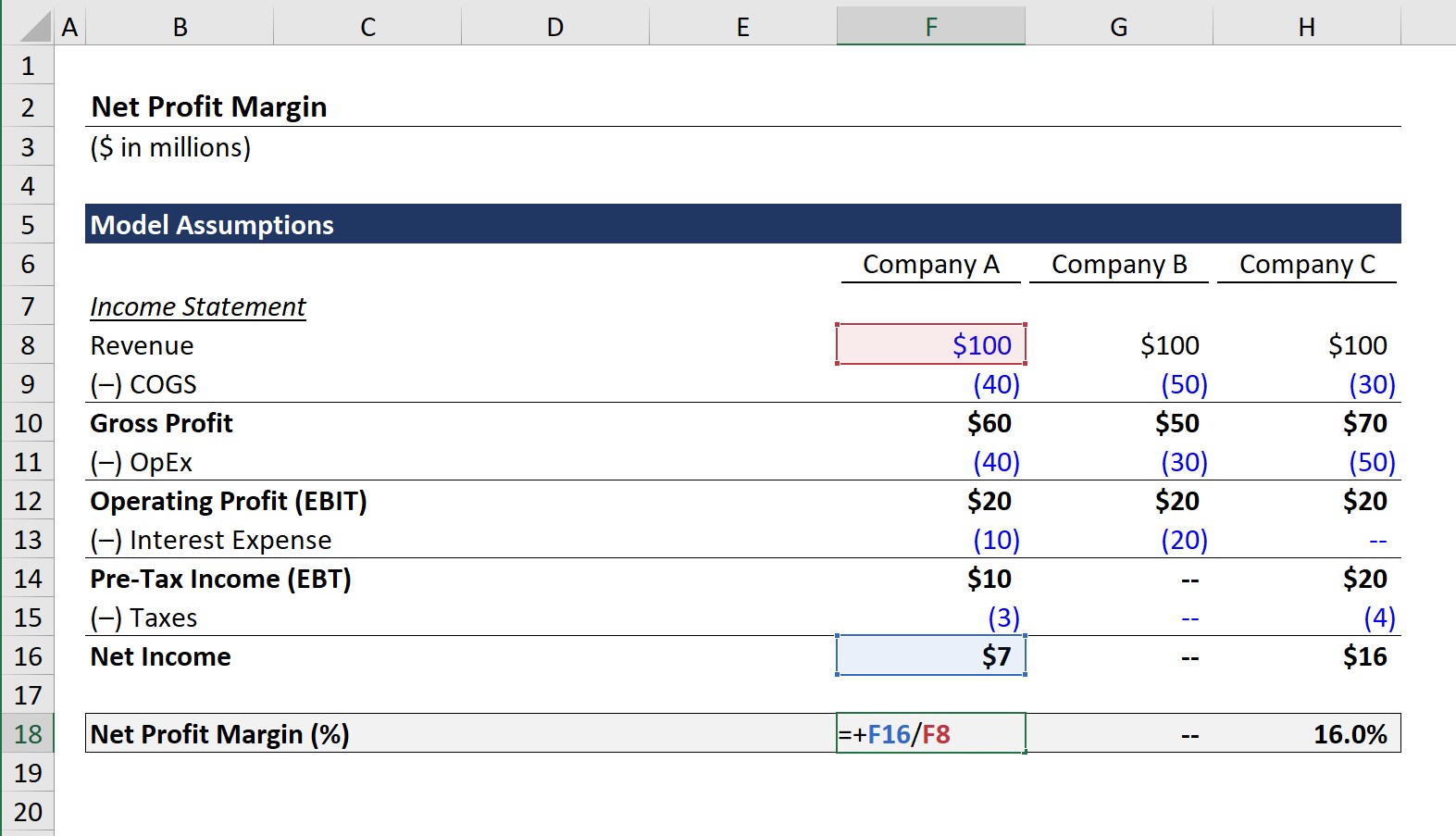

Net Income 40 million. Net Profit Margin Formula Net Profit margin Net Profit Total revenue x 100 Net profit is calculated by deducting all company expenses from its total revenue.

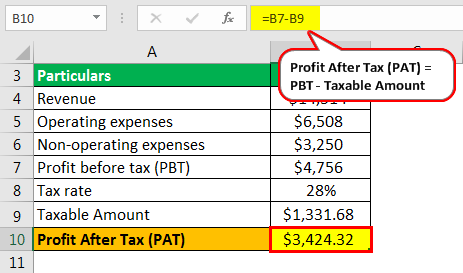

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

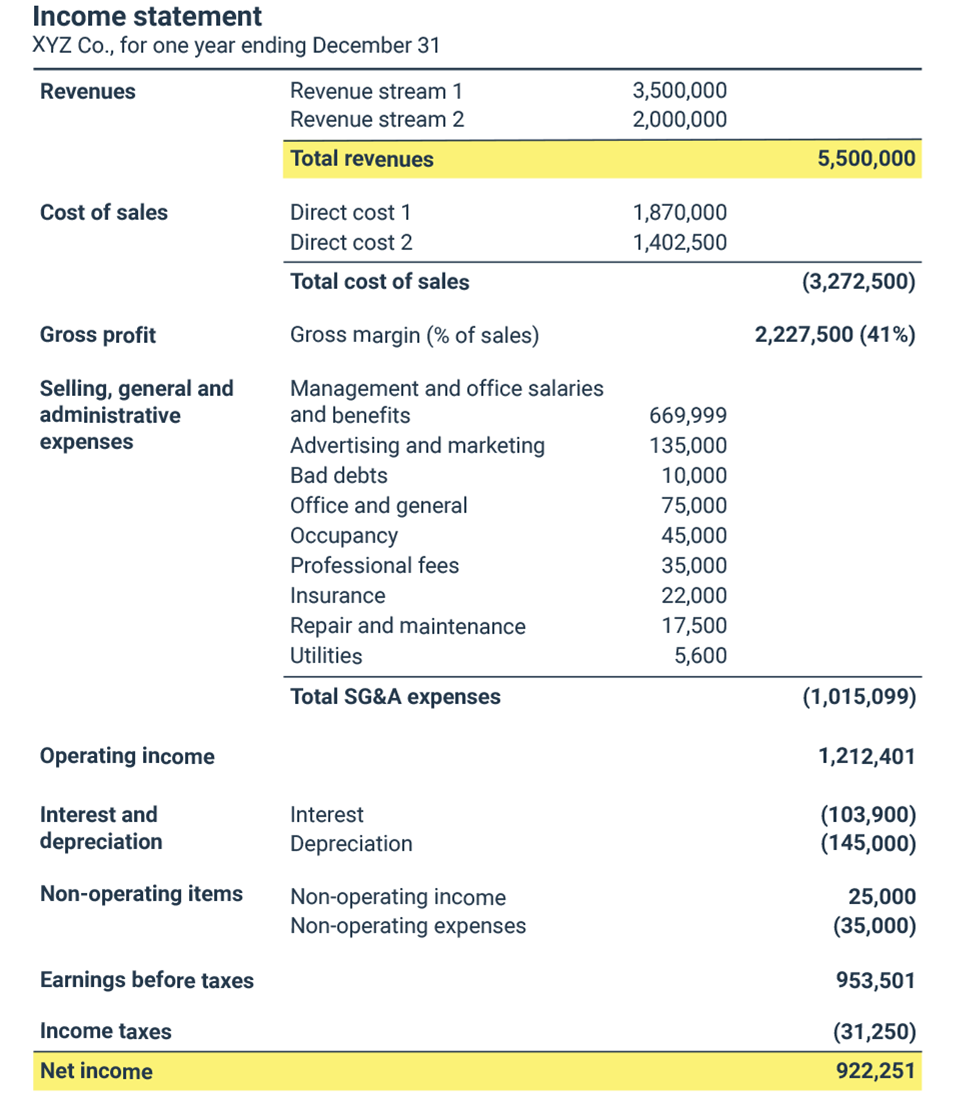

Its operating and non-operating expenses are 15000 and.

. Total Revenue Total ExpensesTotal Revenue Net ProfitTotal Revenue After-Tax Profit Margin By dividing net profit by total. Over a decade of business. The result of the.

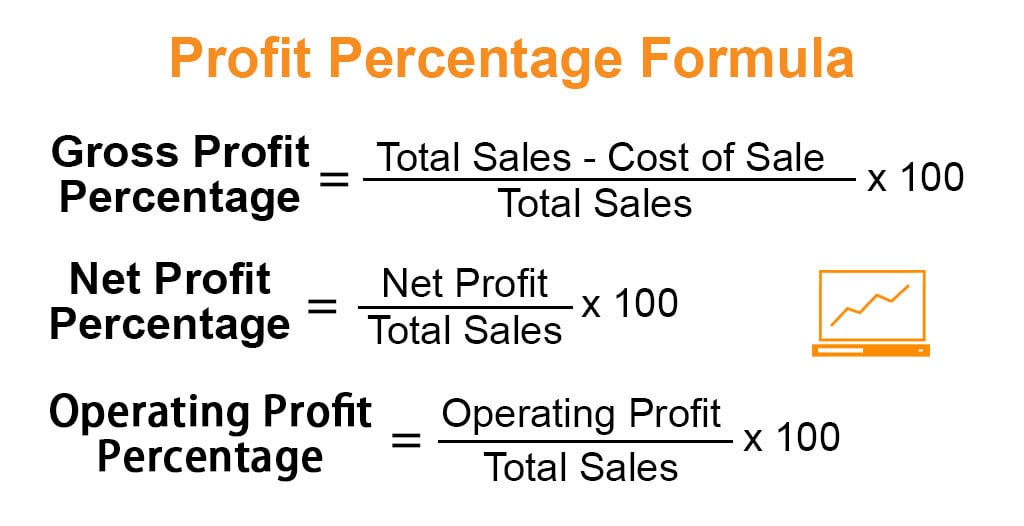

Net profit after taxes is divided by total sales to calculate profit margin. Starts at 49 state fees and only takes 5-10 minutes. Calculation of net profit margins by using a formula.

Net Profit INR 30. This is an approximation. Calculation of net profit.

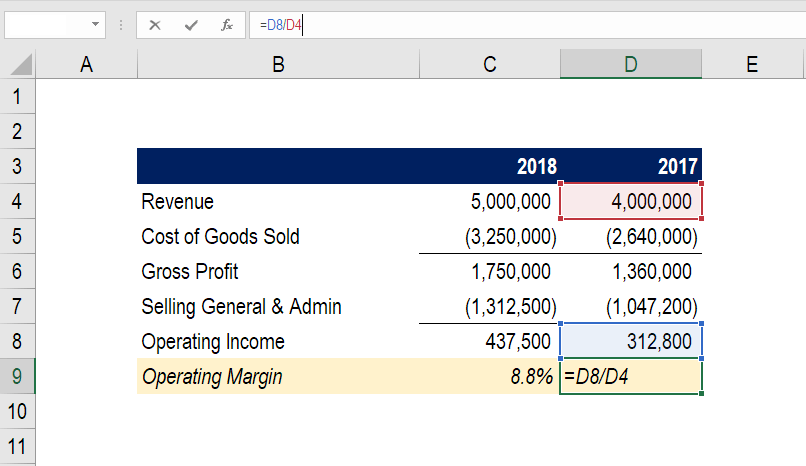

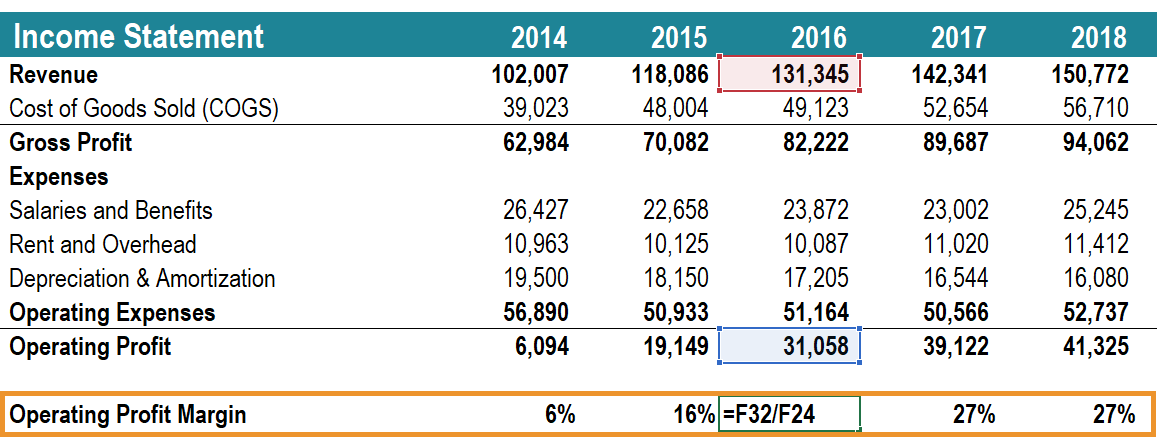

Operating Profit Margin Net Operating Income. The formula for after-tax profit margin is. An after-tax profit margin is a financial performance ratio calculated by dividing net income by net sales.

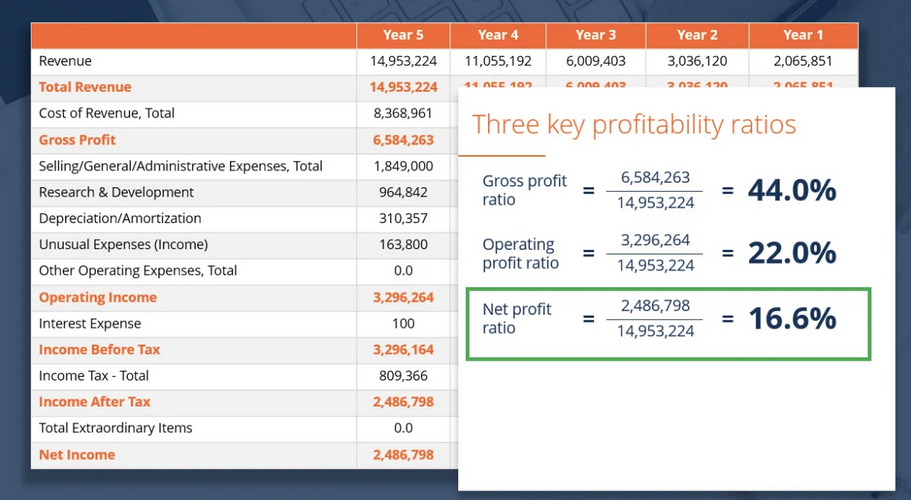

For example if EBIT is 10000 and the tax rate is 30 the net operating profit after tax is 07 which equals 7000 calculation. Using the operating margin formula we get Operating Profit Margin formula Operating Profit Net Sales 100 Or Operating Margin 170000 510000 100 13 100. Net Profit Margin Net Profit Total revenue x 100 Net Profit Margin INR 30INR 500 x 100 Net Profit Margin 600 The company.

The definition of an after-tax profit margin is the percentage of. Its operating and non-operating expenses are 15000 and. 10000 x 1 - 03.

A companys after-tax profit margin is significant because it. The formula for after-tax profit margin is. An after-tax profit margin is a financial performance metric.

This is an important basic measure since it informs investors how much money the company makes. EBT 50 million. To determine profit margin before interest and taxes are considered use the operating profit margin formula which is.

Net Profit Margin Net Profit Revenue Where Net Profit Revenue - Cost Profit percentage is similar to markup percentage when you calculate gross margin. The two inputs we need to calculate the pre-tax margin are the earnings before taxes EBT and the revenue for 2021. Earnings Before Taxes EBT Net Income Taxes EBT can sometimes be found on the income statement Sales Sales revenues recorded in the accounting period A.

An example will help you understand the formula of Net Profit After Tax further-IABC Pvt Ltd earns annual revenue of 50000.

What Is The Gross Profit Margin Bdc Ca

Operating Margin An Important Measure Of Profitability For A Business

How Does Gross Margin And Net Margin Differ

Net Profit Margin Formula And Ratio Calculator Excel Template

After Tax Profit Margin Definition And Meaning Market Business News

Net Profit Margin Calculator Bdc Ca

Guide To Profit Margin How To Calculate Profit Margins With Examples

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Net Profit Margin Calculator Bdc Ca

Gross Profit Margin Vs Net Profit Margin Formula

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Profit Percentage Formula Examples With Excel Template

Net Profit Ratio Double Entry Bookkeeping

Operating Profit Margin Learn To Calculate Operating Profit Margin

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ